Posted on: 12 May 2021

Britannia P&I announces has released the 2021 financial statements, saying the results were satisfactory.

Key points

• Overall surplus after tax of USD37.0m

• Strong investment return of USD59.0m, equivalent to 7.2%

• Negative underwriting result with net claims significantly in excess of net premiums

• Increase in free reserves of USD27.0m

• USD10.0m capital distribution in October 2020

• Strong 2021/22 renewal with growth rate target attained and increases in owned and chartered tonnage

• Part VII Transfer at 20 February moved the majority of the historic book from the UK to Luxembourg

• In March 2021 S&P affirmed the rating of A (Strong) with a Stable outlook for the reorganised and redomiciled Group

• Britannia¹s robust operating model has maintained service standards to Members despite widespread remote working

FINANCIAL OVERVIEW

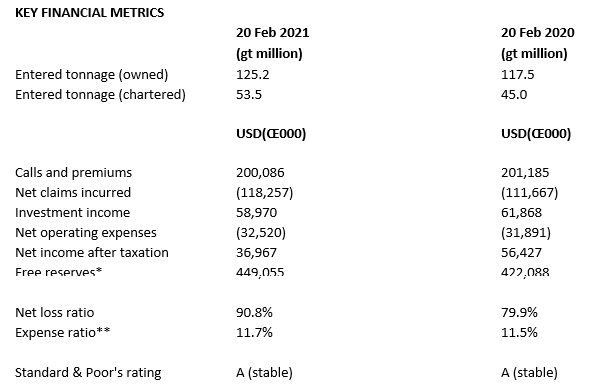

Total calls and premiums for 2020/21 were marginally lower than the previous year. The underwriting result was a deficit of USD20.5m before allowing for the investment return allocated to the technical account. The strong investment performance achieved for the financial year ended resulted in an overall surplus for the year of USD37.0m after tax. In October 2020 there was a capital distribution to Members of USD10.0m. The total capital resources of the Group therefore increased by USD27m to USD449m at 20 February 2021. Additional assets totalling USD177.8m held by Boudicca Insurance Company Limited are available to Britannia to meet future claims.

CLAIMS

Claims incurred in the financial year increased to USD118.3m (USD111.7m in the previous year). Retained claims incurred in the 2020/21 policy year at the 12-month stage were USD136.6m, marginally higher than the 2019/20 policy year at the same time. 20 claims that are currently expected to cost more than USD1.0m were reported, with an aggregate estimate of USD63.4m. This is very similar to the previous year, which also saw 20 incidents reported with an aggregate cost of USD69.5m. However, claims on the Pool in 2020/21 were significantly higher, with the 12-month figure at a record high of USD478.1m compared to USD355.4m in 2019/20. There were improvements in earlier policy years allowing releases of USD72.5m from the claims provisions held in respect of those years which helped to offset the increased provisions required in respect of the 2020/21 Pool position.

CHAIRMAN’S STATEMENT

Anthony Firmin, Britannia’s Chairman, commented as follows: “Despite the challenges of remote working and limited opportunities to meet Members face to face, caused by the Coronavirus pandemic, Britannia has been able to maintain its high standards of service to Members. During this period, the regional hubs have played a vital role in staying in touch with our Members and providing uninterrupted service. Added to this, our recently upgraded IT system has further strengthened Britannia’s robust operating model.

“Britannia starts the new year with record tonnage after finalising the difficult process of negotiating the renewal remotely. While I welcome our new Members, the club¹s growth comes mainly from existing or returning Members. For me, this is the real confirmation that Britannia provides a service which is appreciated and valued by our Members. Britannia’s financial strength is evidenced by the S&P ‘A’ rating with a continuing ‘stable’ outlook and our ability to return excess capital to Members when this is appropriate.”

* Britannia benefits from a reinsurance contract with Boudicca Insurance Company Limited and in addition to Britannia’s free reserves shown above Boudicca¹s surplus assets are available to meet Britannia¹s future claims. These were USD177.8 m at 20 February 2021 (USD172.3 m at 2020)

** In accordance with the International Group Agreement 2020 Britannia is required to disclose the average expense ratio for its P&I business for the past five years. This measures all of Britannia¹s costs, except those related directly to the management of claims, as a percentage of call, premium and investment income for a five year period.

Britannia’s Review of the Year – 20 February 2021 is available to view on the Club’s website www.britanniapandi.com.